Planning redundancies once your employees’ wage subsidy runs out? Not so fast!

Times are tough for many New Zealand businesses right now. As a result of Covid-19 and its implications, many businesses have had to lay off staff or temporarily or permanently close due to significant decreases in revenue.

Fortunately, many businesses have been able to access the Government Wage Subsidy, which provided a flat rate covering each employee for a period of 12 weeks, in order to ensure workers continue to receive income, albeit in many cases reduced.

Employers who applied for the wage subsidy after 4 pm on 27 March 2020 must retain those employees for the duration of the period of the wage subsidy and use their best endeavours to pay workers at least 80% of their usual wages.

For employers who applied on 27 March 2020, the 12 week period expires on 19 June 2020. Theoretically, these employers are then no longer obligated to retain their staff. We expect many businesses to reassess their position and staffing levels in the coming weeks.

For these businesses, employment law obligations continue to apply, regardless of the Covid-19 pandemic.

If you are considering restructuring once the wage subsidy expires, you must comply with your legal obligations (consultation in particular) or you may open your business to unwanted personal grievances.

So, what’s next?

Businesses are entitled to make genuine business decisions, which may include restructuring your business with redundancy arising. A redundancy situation arises where an employee’s position is superfluous to the employer’s needs.

Before commencing a redundancy process, it is best practice to consider other options that may be available to the business. To protect your business against personal grievances and unjustifiable dismissal claims, it is important to consider what a fair and reasonable employer would have done in the circumstances.

Wage Subsidy extension

On 14 May 2020, the Government made its 2020 Budget announcement. Part of this year’s budget is an extension of the Covid-19 wage subsidy for employers who continue to be significantly impacted by Covid-19.

If available to your business, the wage subsidy extension may be a suitable option to consider prior to a restructure.

At this stage, the following limited information has been released in respect of the extension:

- Employers cannot apply for the extension until their employees’ initial 12 week wage subsidy has finished

- Applications for the extension are open from 10 June 2020 until 1 September 2020 (a 12 week period)

- The extension will only cover 8 weeks per employee from the date of application (compared with the 12 week cover under the initial subsidy)

- The eligibility criteria for the extension have been tightened. An employer must have had, or expect to have, a revenue loss of at least 50% for the 30 days before an application is made, compared to the closest period in time last year

- The employer must agree to the same obligations as under the original subsidy, such as:

o Passing the subsidy to its employees;

o Retaining employees for the duration of the subsidy;

o Making best endeavours to pay employees at least 80% of their normal pay; and

o Taking active steps to mitigate the impact of Covid-19 on the respective business.

If you are not eligible for the wage subsidy extension, have considered all other options and still believe there is a genuine business need for redundancy, it may now be time to commence the process.

The redundancy process

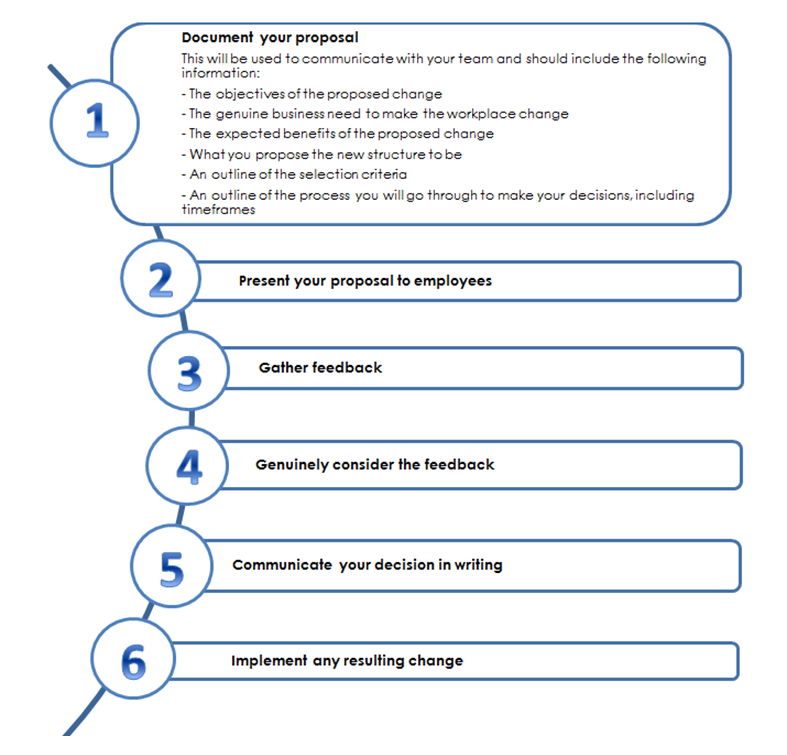

A redundancy process must be consulted on in accordance with good faith requirements. This means that employers considering redundancies must engage with employees and their representatives meaningfully, provide them with as much time as possible to consider and respond to any proposal for change, and consider any feedback and concerns raised.

The following steps should be followed:

Common mistakes

Don’t:

- Jump into a redundancy process without a plan. It should only happen after all other options have been considered

- Treat the proposal as a done deal before you have heard and considered feedback

- Leave too little time between the above steps

Remember, redundancies can be challenged. To avoid a personal grievance being raised against you/your business, any dismissal as a result of a redundancy process must be objectively justifiable. This means the redundancy is based on substantive reasons (i.e. a genuine business need) and the procedure by which an employer reached the decision must be procedurally fair.

If you have any questions about the above or require assistance with a redundancy process, please contact Jaesen